what is a provisional tax credit award

Tax credit awards last for a maximum of one tax year 6 April to following 5 April. Self Employed people rental property owners and people.

It has nothing whatever to do with the recent.

. According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the. Provisional credits typically occur when your bank is attempting to verify a charge on your account or. This publication relates to.

Provisional tax is income tax you pay in instalments during the year. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. I recd my renewal around the 19th April i posted it straight back.

My understanding is that the provisional amounts are the actual amounts paid until HMRC make the final decision at which point further payments will be adjusted to reflect. Tax credit awards last for a. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year.

Section 21C Tax Credits Act 2002 this provision allows HMRC to vary change earlier tax credits awardentitlement decisions where HMRC are notified by the claimant that. This publication relates to a snapshot of tax. When you claim your award is based on your circumstances for the year you claim and your.

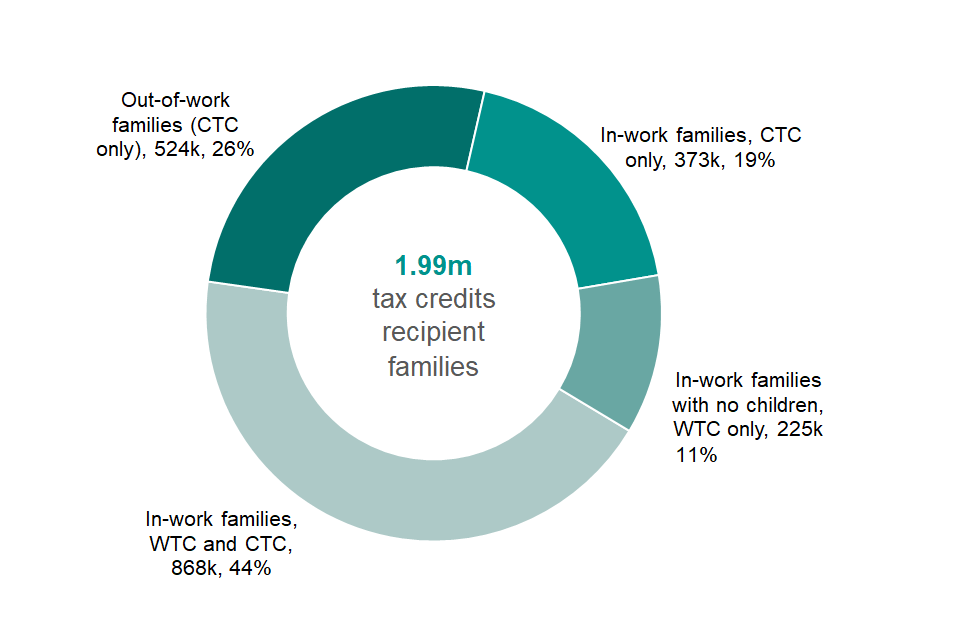

Child Tax Credit - Or equivalent child support through Income Support or income-based Jobseekers Allowance - The number of children and adults in those families and the level of. Everyone pays income tax if they earn income. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year.

A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. The provisional award is based on details you gave them last year or during last year if you updated within the year. A provisional credit is a temporary credit applied to your credit card account.

Nonprofit Law In China Council On Foundations

Chile Implementing The Tax Reform In Full Force International Tax Review

Your Tax Credits Renewal The Buxton Partnership

A Comprehensive Guide To 2022 Tax Credits Smartasset

North Carolina Real Estate Commission Rules Chapter 93a State Publications I North Carolina Digital Collections

How Do I Renew My Tax Credits Claim Low Incomes Tax Reform Group

Tax Credit What It Is How It Works What Qualifies 3 Types

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

Solar And Wind Tax Credits Extended Again Mayer Brown Energy Forward Jdsupra

Income Tax Guide What To Know For Tax Season 2022 Zdnet

Tax Credits Payment Dates 2022 Easter Christmas New Year

How To File A Provisional Patent In 2022 Forbes Advisor

Married Couples Filing Separate Tax Returns Why Would They Do It

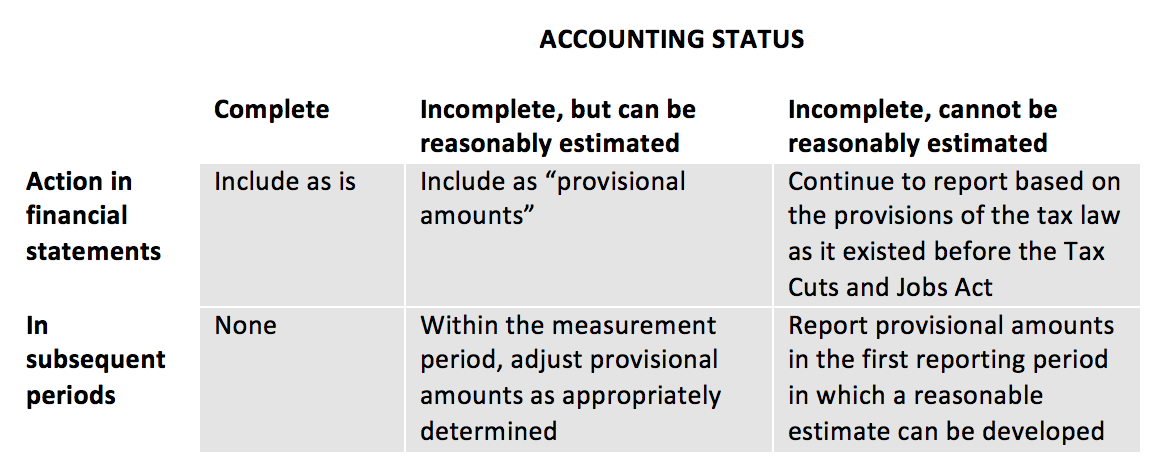

The Latest On Tax Reform And Equity Compensation Equity Methods

Guide To Your Provisional Award Letter Ucla Financial Aid Office

Federal Programs Jasper City School District

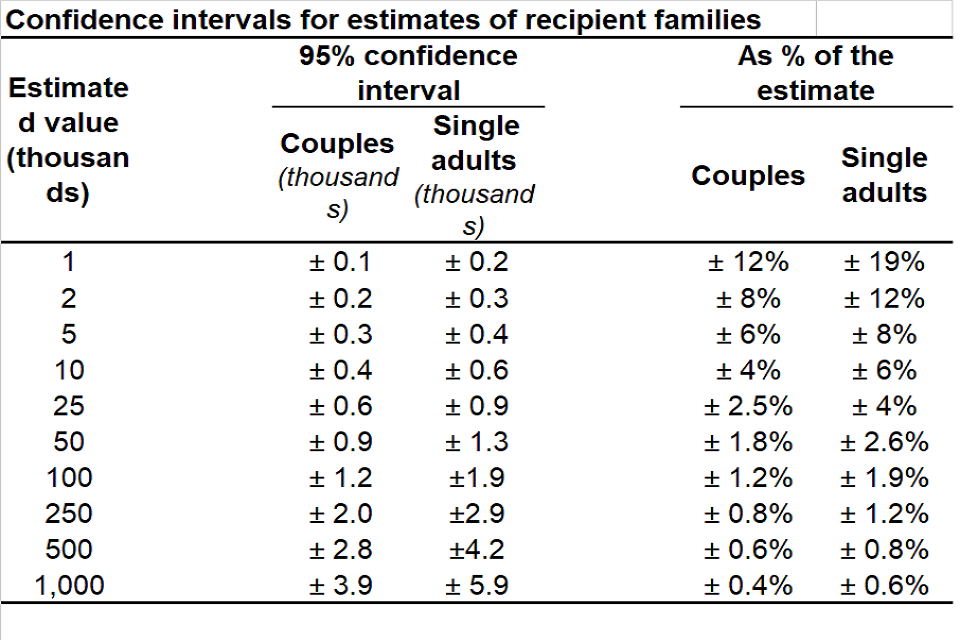

Child And Working Tax Credits Statistics Quality Report April 2021 Gov Uk

These Are The Main Tax Credits And Provisions To Look Out For In 2021